Dangers of Applying for Credit Cards

Credit cards can be powerful tools for building credit, earning rewards, and managing finances. However, like any financial instrument, they come with potential dangers. Here's a breakdown of the pros and cons to help you decide if applying for a credit card is right for you.

Pros

- Build Credit: Using a credit card and making on-time payments demonstrates responsible credit behavior, which can significantly improve your credit score. This can lead to better interest rates on loans and easier access to credit in the future.

- Rewards: Many cards offer rewards programs that give you cash back, points, or travel miles for your spending. These rewards can add up over time, effectively giving you discounts on purchases.

- Convenience and Security: Credit cards offer a safe and convenient way to pay. You don't carry large amounts of cash, and most purchases come with fraud protection.

- Managing Finances: Credit card statements provide a clear record of your spending, helping you track your budget and identify areas where you can cut back.

Cons

- Debt Trap: Credit cards are easy to overuse, especially with high spending limits and readily available credit. The interest rates on credit card debt are typically much higher than other loans, making it a very expensive way to borrow money.

- Credit Score Impact: Applying for too many credit cards in a short period can negatively impact your credit score due to "hard inquiries" on your credit report. Additionally, missing payments or carrying a high balance can significantly damage your score.

- Annual Fees: Some cards, particularly rewards cards, come with annual fees. Make sure the rewards outweigh the fees before applying.

- Temptation to Overspend: The ease of swiping a card can lead to impulse purchases and overspending. It's important to have strong financial discipline to avoid racking up debt.

Before Applying

- Do your research: Compare different cards and their features (interest rates, rewards programs, annual fees) to find one that best suits your needs.

- Be honest about your spending habits: If you struggle with impulse purchases, a credit card might not be the best choice.

- Have a plan for repayment: Always pay your balance in full and on time to avoid accruing interest charges.

Final Thoughts

Credit cards can be valuable tools, but it's crucial to understand the potential risks before applying. By being responsible with your spending and managing your credit wisely, you can leverage the benefits of credit cards and build a strong financial future.

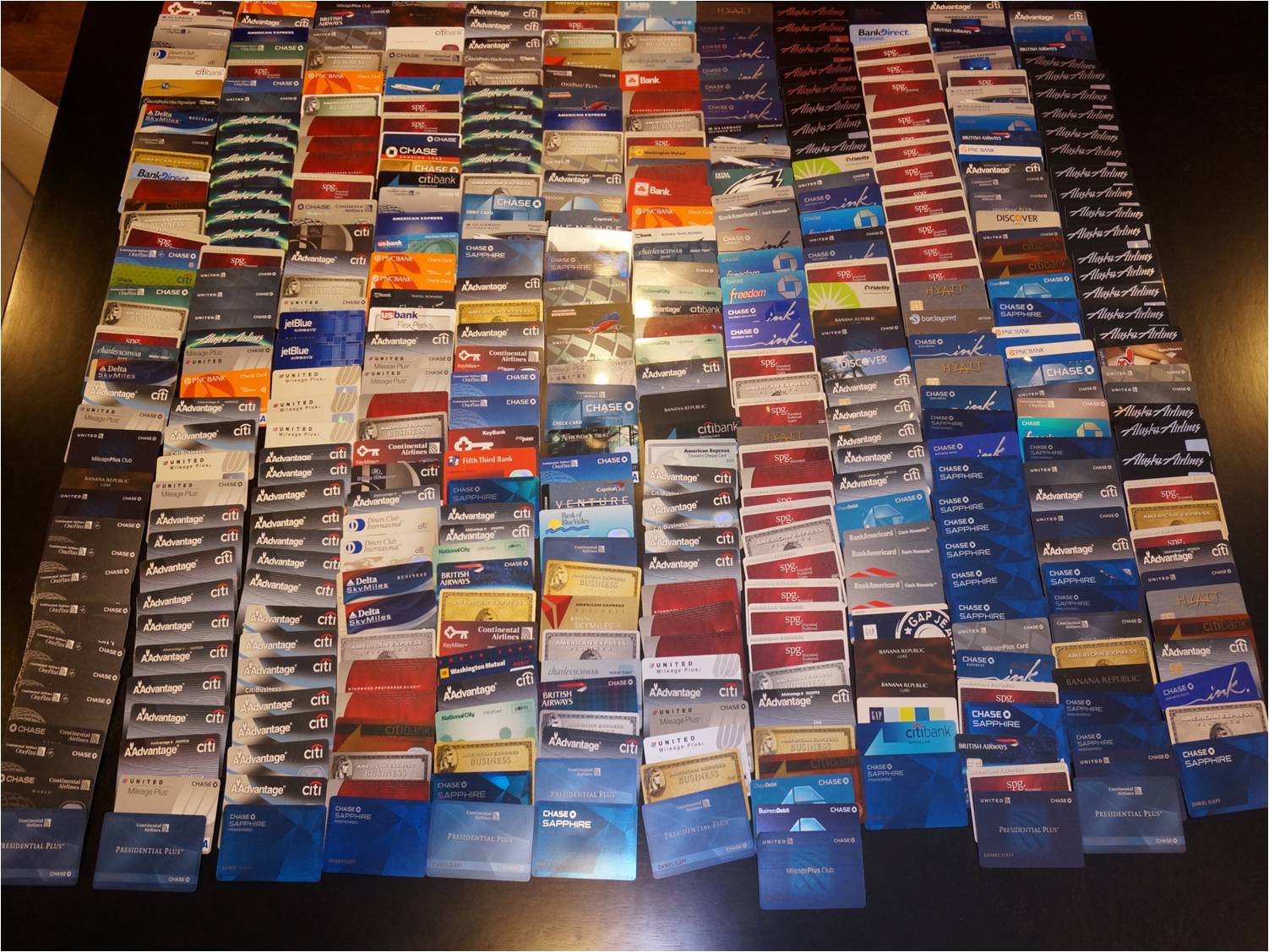

While we have a very interesting hobby it doesn’t come without its dangers.