Credit Card Review: Chase Sapphire Reserve

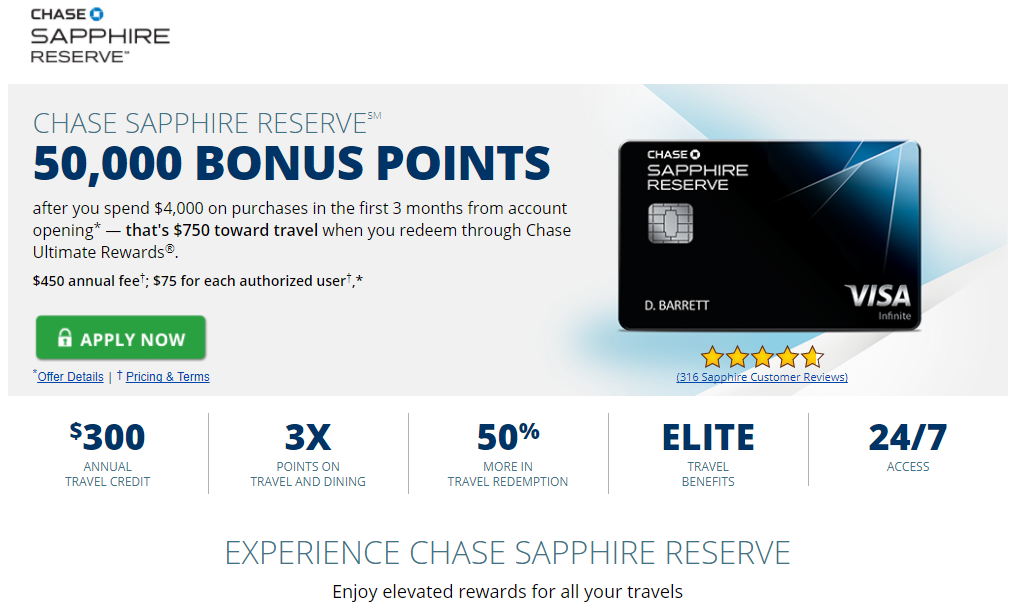

When the Chase Sapphire Reserve exploded on to the market about one year ago it changed the game of premium credit cards. Chase went all in on this credit card offering a huge signup bonus of 100,000 Ultimate Reward points worth about $1000 of raw cash or $1500 in travel redemptions. Along with its $300 of travel credit that applies to anything travel related and access to transfer points to premiere transfer partners this is one sexy card.

Click Here To Apply For The Chase Sapphire Reserve Credit Card

Before the Chase Sapphire Reserve premium travel credit cards like the American Express Platinum or the Citi Prestige cards didn’t offer any decent bonus categories beyond hotels and travel. When the Chase Sapphire Reserve blasted on to the market not only did they offer 3X on travel but they offered 3X on dining as well which is huge for most people. This was an additional point on top of their standard travel card, the Chase Sapphire Preferred.

Now let’s move on to the all important travel credit that most of these premium cards come with. The Chase Sapphire Reserve comes with $300 of annual travel credit, the American Express Platinum comes with $200 in fee reimbursement, and Citi Prestige comes with $250 air travel credit. The American Express and Citi travel credits only apply to fees imposed by airlines they can’t be used directly for flight purchases. Although there are ways to get around this it may be difficult to use the entire credit if you don’t check bags or make purchases that applies to the fees. However, the Chase Sapphire Reserve is different, anything that codes as travel will use this credit. This means that your Uber rides, hotel purchases, airfare purchases, parking lots, anything that Visa categorizes as travel will use this credit. It makes this incredibly useful to use and I ended up blowing through mine within the first three months it’s go good.

Features

- $450 Annual Fee

- $300 Annual Travel Credit

- Earn 3X points on travel (airfare, hotels, and anything that codes as travel)

- Earn 3X points on restaurants

- Earn 1X points on everything else

- 50% bonus on travel redemptions

- $100 credit for Global Entry or TSA Pre✓ applications

- 1:1 point transfer to airline and hotel loyalty programs

- Primary car rental insurance

- Access to 1,000+ airport lounges worldwide with Priority Pass Select

- Special benefits during your stay with The Luxury Hotel & Resort Collection

- 24/7 direct access to a Customer Service specialist

- Access to Visa Infinite Concierge who can help you with requests like dinner reservations, or Broadway, music and sporting event tickets

Current Transfer Partners

- British Airways Executive Club

- Flying Blue AIR FRANCE KLM

- Korean Air SKYPASS

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- IHG® Rewards Club

- Marriott Rewards

- The Ritz-Carlton Rewards

- World of Hyatt

Final Thoughts

$450 is a lot to stomach for a premium travel card, but if you travel a lot the bonus points and value you get out of the card will be worth it. While you may pay $450 for an annual fee you also need to subtract the value the card gives you, including $300 for travel reimbursements, $100 for the first year and every 4 years after that for Global Entry or TSA Pre✓ applications, and however much you value for the extra perks like lounge access and 50% bonus on travel redemptions. For me this card is going to be a long-term keeper, for as much as I travel and eat out the extra bonus points are worth it. I enjoy the lounge access the card gives you and premiere service you get when calling in. Ultimate Reward points are extremely powerful for travel redemptions and transfers which makes them extremely desirable.