Why I'm Keeping My Chase Sapphire Reserve

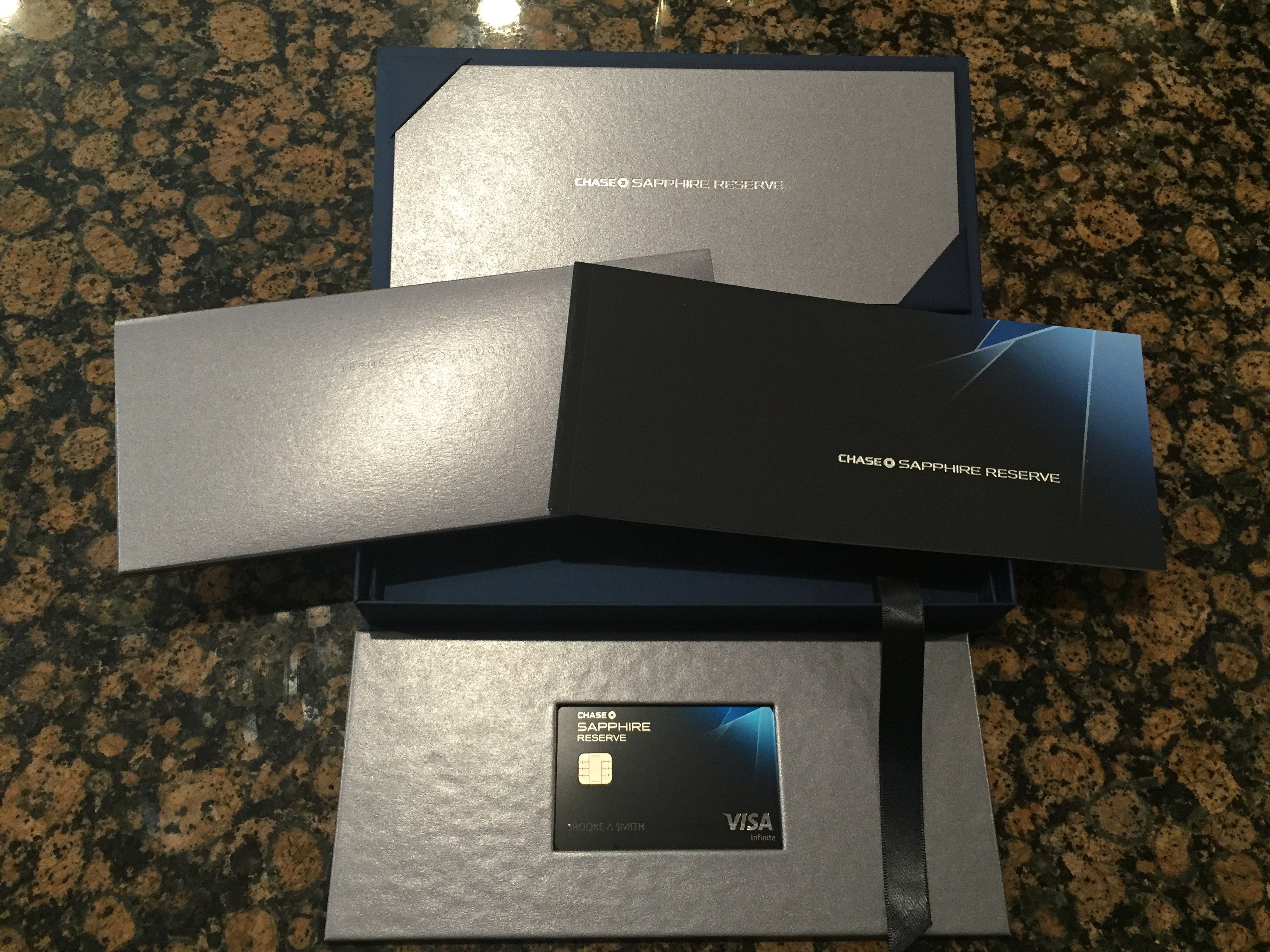

It’s been just over a year since the Chase Sapphire Reserve came out and just two months away from when my annual fee is going to hit for my card. While normally people will churn and burn premium cards just for their sign up bonuses or features this is one I’m actually going to be keeping.

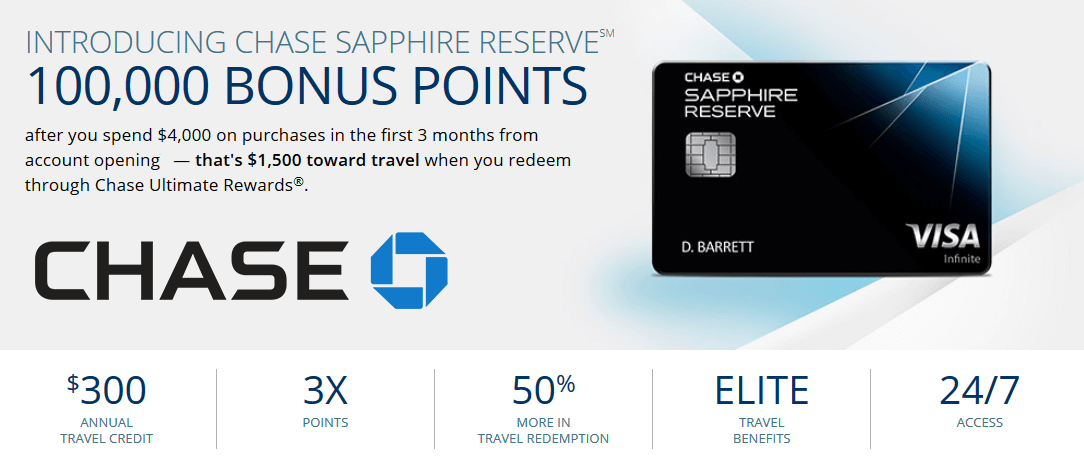

I was lucky to pounce on the Chase Sapphire Reserve when I did, with recent rule changes and downgrade of the bonus I hit it at the best possible time. Chase’s new rule restricts you to only holding one of the Sapphire family of cards, so you can’t stack that with the Chase Sapphire Preferred. On top of that when the card first launched it had a mind-blowing 100,000 point sign up bonus which made the card extremely desirable. If you used that for travel it was worth an astounding $1500. Now the Sapphire Reserve only comes with a 50,000 sign up bonus which is equal to the Sapphire Preferred bonus currently available.

As I outlined in my review it’s an amazing card to own, especially for my spending habits it hits the right places. For a card that earns 3X on anything loosely related to travel, even parking garages count, and for dining expenses the bonus multiplier is perfect for me. If it’s two things I do on a daily basis, it’s eating out and traveling.

Calculating my break even point for the card wasn’t very difficult, take the $450 annual fee and subtract the very generous $300 travel credit which is good for almost anything travel related, even parking garages. This leaves us with an effective $150 annual fee card, then you can just see that to break even you would need to spend $5000 on 3X purchases or $15000 of 1X purchases to break even. For someone who eats out a lot I put way more than $5000 on my card’s 3X bonus, and even more on my travel expenses.

That’s just the raw value of the card that we calculated, we could also add up all the perks the card gives you for Priority Pass access to lounges all over the world when traveling, and the TSA Pre✓ which increases the value of this card even further. On top of that each Ultimate Reward point you earn is worth 50% more, meaning at its base it’s a 1.5% earning card for base points. By holding this card and using it to redeem travel you’re getting the maximum value out of this card.

On top of that still it has some premium transfer partners you can move your points to, this can put you even closer to your next redemption for travel. Its travel partners include United, Southwest, IHG, British Airways, Singapore Airlines, Marriott, Hyatt, and more. All of these partners mean even more of an opportunity to book travel to where you want to go.

The value that I get out of this card is just too much compared to other cards I could earn on. I will admit that I’ve already replaced one feature of this card with another. I also now hold an American Express Platinum Business card which gives me exclusive access to Centurion Lounges and Delta Sky Clubs (when I’m flying Delta). While the Priority Pass is a fantastic bonus for lounge access the two best series of lounges are by American Express and Delta, so that has replaced my lounge visits while I’m traveling.

Final Thoughts

At the end of the day it’s still a $450 annual fee card and some people cannot compel themselves to pay that much for a credit card. There will probably be a point where I am not getting the full value of my anymore and at that point I will seriously consider canceling it. For now with as much traveling I am doing and how powerful Ultimate Reward points are I cannot see myself without this card. Every year when the annual fee is close to posting I will have to revisit and calculate if the card is still working in my favor. So far this year I’ve gotten more than enough value out of this card and will even get more value continuing on to the end of this year. Sometimes these premium travel cards just make sense for the value, and I can happily say the Chase Sapphire Reserve is my favorite card.