What Happens When an Airline Files for Bankruptcy?

Airline bankruptcies have become a significant topic of discussion, particularly as the aviation industry faces cyclical downturns, rising fuel costs, and unforeseen disruptions like global pandemics. When an airline files for bankruptcy, it doesn't always mean the end of the airline, but it does have far-reaching consequences for passengers, employees, creditors, and the overall aviation ecosystem.

Types of Bankruptcy: Chapter 7 vs. Chapter 11

In the United States, when an airline files for bankruptcy, it typically falls under either Chapter 7 or Chapter 11 of the U.S. Bankruptcy Code, depending on the situation:

- Chapter 7 Bankruptcy: This represents a liquidation scenario, where the airline ceases operations entirely, its assets are sold off, and the proceeds are distributed among creditors. The airline essentially goes out of business. For passengers and employees, this is the most disruptive type of bankruptcy, as flights are canceled, employees lose their jobs, and the airline's brand disappears.

- Chapter 11 Bankruptcy: This is more common and allows an airline to reorganize its operations while continuing to fly. Chapter 11 grants the airline protection from creditors while it restructures its debts, renegotiates contracts (such as aircraft leases), and finds ways to improve its financial health. Many airlines have used Chapter 11 to emerge stronger after shedding unsustainable obligations. This process is often seen as a "reset button" rather than the end of the airline.

What Happens to Passengers?

One of the biggest concerns when an airline files for bankruptcy is how it will affect passengers who already have booked flights. The outcome depends largely on the type of bankruptcy filed and the airline's restructuring plan:

- If the airline is filing for Chapter 11, passengers are typically allowed to fly as usual. Flights continue, and the airline works to ensure that its operations are unaffected. However, there may be disruptions, including possible changes to schedules, cancellations of non-profitable routes, or even reductions in service.

- For Chapter 7 bankruptcies, passengers may face immediate cancellations. If the airline ceases operations, those with tickets may be left scrambling for alternatives. In such cases, airlines are generally required to offer refunds or alternative arrangements, though processing such claims can take time. Some passengers might be protected under credit card company policies or through travel insurance.

Additionally, frequent flyer programs can be impacted. In Chapter 11 cases, these programs usually remain intact, but if the airline ceases operations altogether, the points and miles accrued may become worthless.

Impact on Employees

Airline employees are often hit hard when their employer files for bankruptcy. In a Chapter 11 reorganization, the airline may cut jobs, reduce wages, or renegotiate labor contracts to lower operating costs. Many airlines also reduce their workforce by closing unprofitable hubs and cutting back on routes. While layoffs are common, the hope is that these measures will allow the airline to survive in the long run.

In a Chapter 7 liquidation, all employees lose their jobs as the airline ceases operations entirely. Severance packages, unpaid wages, and pensions can be at risk depending on the airline's financial situation and its ability to satisfy outstanding obligations.

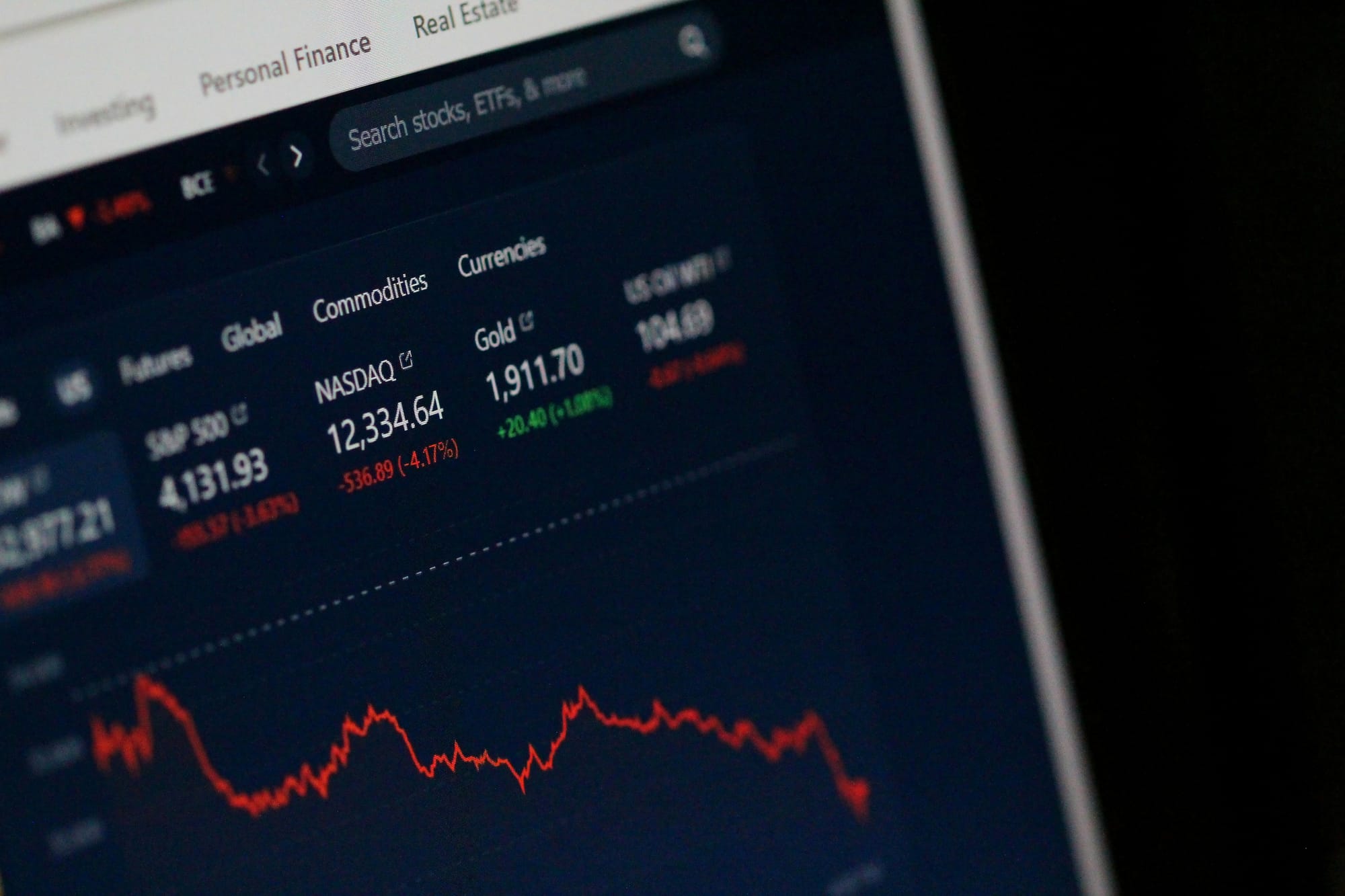

Impact on Shareholders and Creditors

Shareholders and creditors often face financial losses during bankruptcy proceedings. In Chapter 11 bankruptcies, creditors (such as aircraft leasing companies, banks, and suppliers) are usually asked to take reduced payments or may have to wait for longer periods to be paid. Some creditors might end up owning equity in the reorganized airline, which means they become shareholders in the business.

Current shareholders often see their investments lose value, as shares in bankrupt companies typically plummet. In some cases, shares might even be canceled.

In Chapter 7 liquidations, creditors receive payments from the sale of the airline's assets, but these are typically far less than the amount owed. Shareholders usually lose their entire investment, since liquidation rarely covers equity holders after paying off secured creditors.

Reorganization and Recovery

For airlines that file for Chapter 11, bankruptcy is not necessarily a death sentence. Many airlines have successfully emerged from bankruptcy stronger and more competitive. This involves a detailed process of reorganization, including renegotiating contracts, securing new financing, and finding ways to cut costs while maintaining operations.

Several major U.S. airlines have filed for bankruptcy over the past few decades and survived. American Airlines, United Airlines, and Delta Air Lines all filed for Chapter 11 during the 2000s but emerged as profitable, larger airlines. The reorganization period allows these carriers to streamline their operations, renegotiate labor contracts, and often reduce their fleet size or retire older aircraft. This makes them more efficient and able to compete more effectively in a challenging market.

The Role of Government and Regulators

In some cases, government intervention may play a role. National governments may offer bailouts or financial aid to struggling airlines, especially when a carrier is seen as critical to the country’s economy or infrastructure. Governments may also impose regulations on how an airline can restructure, particularly in cases where jobs or national security are at risk.

Regulators like the U.S. Department of Transportation (DOT) or the European Union Aviation Safety Agency (EASA) closely monitor airline bankruptcies to ensure passenger rights are respected, and safety standards are maintained during financial restructuring.

Final Thoughts

When an airline files for bankruptcy, it sends ripples through the entire aviation industry, affecting passengers, employees, creditors, and shareholders. The type of bankruptcy, the airline’s financial health, and the effectiveness of its restructuring plan all determine whether the carrier can recover or if it will disappear from the skies entirely.

For passengers, the best course of action is to stay informed and, when necessary, take precautions like booking with credit cards or purchasing travel insurance. For airlines, bankruptcy can either represent an opportunity for renewal or the final chapter of their operations. As history has shown, while some airlines manage to emerge stronger, others may not survive the turbulent skies of financial distress.

Ultimately, aviation is a complex industry deeply tied to global economics, and airline bankruptcies, though disruptive, are part of the natural ebb and flow of business. For many carriers, bankruptcy offers a chance to reinvent themselves and continue flying with renewed purpose.